Enabled:

¤ | ¤

A Go-to-Market & Commercialization Capability model represents a stable backbone of processes and capabilities, that quickly adapt to agile cross-functional initiatives.

Adjustable to strategic changes,

it balances short-term performance & long-term sustainability.

A DEEP-ROOTED GO-TO-MARKET CAPABILITY ENABLER

Francisco Toste

Founder | GM

- Executive MBA by IESE / AESE

(#1 global MBA 2021 by The Economist)

- Negotiation Dynamics, executive program by INSEAD

- Economics degree by Nova University of Lisbon (Portugal's top)

+25y of executive leadership blend in leading firms across geographies and functions, including customer excellence, commercial operations, general management, and finance.

20y in healthcare

/ 27y overall

¤

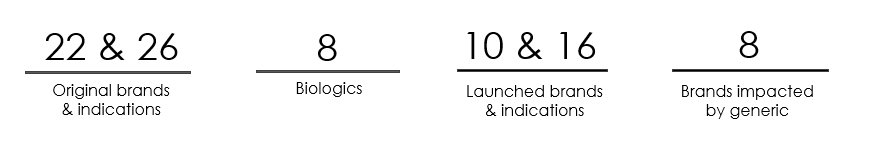

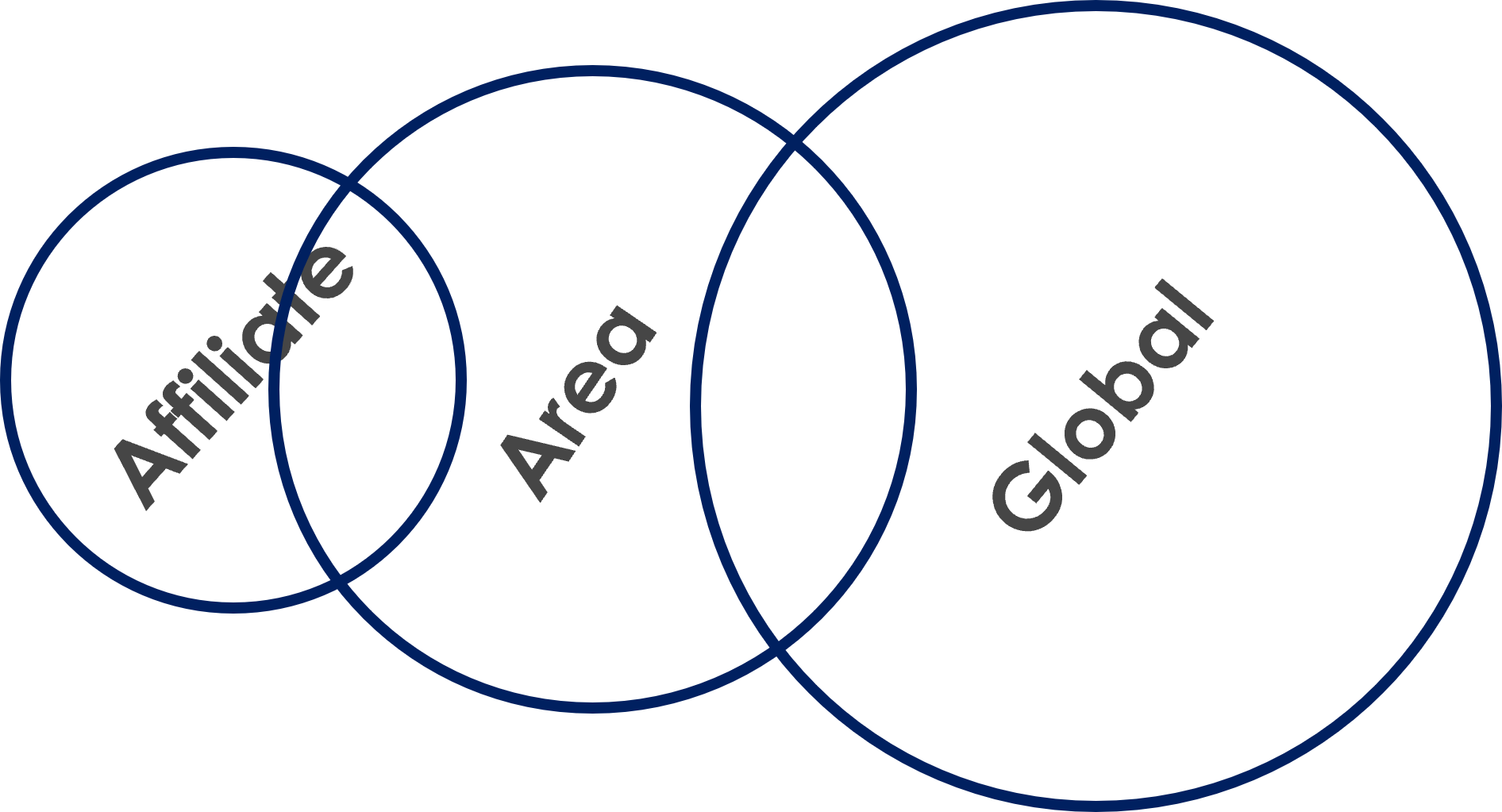

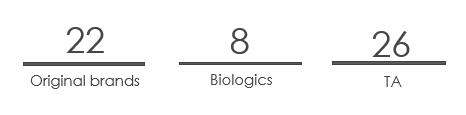

Toste - Healthcare Consulting, experts in Healthcare GtM and Commercialisation Capability, executes on the strategies. with experience in affiliate, area and global scopes. Several healthcare companies - including Wyeth / Pfizer, Abbott and Abbvie - permitted exposure to 20 brands & 26 indications (including 8 biologics), during different lifecycles. Of these, 10 brands & 16 indications were launched, and 8 brands were impacted by generics.

¤

WHY REINFORCE THE HEALTHCARE GtM

& COMMERCIALISATION CAPABILITY?

The case for a change

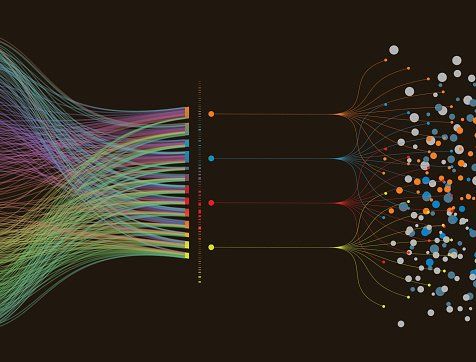

The picture above exemplifies a GtM & Commercial Capability model, represented by thin threads, people & other resources, intertwined to few larger threads (tactics), and delivering mutually connected solutions & goals. The strategy is the plan and set of activities to reach these goals.

If there are no secrets to evolve, experience and strategic will are needed to:

- Put patients at the center,

as strategy endpoint. All the other stakeholders are enablers and gate keepers.

- Develop a management cultural evolution, truly believing in teams' purpose, ensure capacity, give autonomy, with accountability, flexibility, resilience, and ethics. An agile mindset is mandatory.

- Create multidisciplinary teams and structures to interface with multiple stakeholders - HCPs are squeezed between government regulations, patient organizations increased maturity, and providers' negotiate harder.

- Modernize processes to foster agility, efficiency and insights visibility.

Imagine a compliance tool for all external stakeholders interactions, to transfer the ownership from the ethics department to the actors.

- What are the needed capabilities? There is no 'model fits all'.

E.g.,

should the multi-channel be in the IT or just the technical piece? Why not have the patient support programs in customer operations - is this legal?

- Insights management - Have a clear strategy for data collection, curation, aggregation, and only then start to derive insights to take decisions, defining feedback loops so the teams can constantly adapt their actions.

Structuring a GtM model

A GtM model

involves people, capabilities, and processes needed to launch & market a product or indication. A healthy one adapts to strategic changes, balancing short-term performance with long-term sustainability. However,

an operational commercialisation model by a brand is different:

- The first is an umbrella that gives the structure and standards to act, transversal to all the company, usually with flexibility for brands. In general, it is managed by a commercial and operations excellence department.

- The second materializes and provides content in order to achieve specific objectives, often with the direct involvement of the previously stated team, for customization and smooth operations.

Two examples:

- Have a company brand plan methodology, then have brand teams issuing their own.

- A specific brand patient support program is developed, it is then adapted and expanded to other brands, if required.

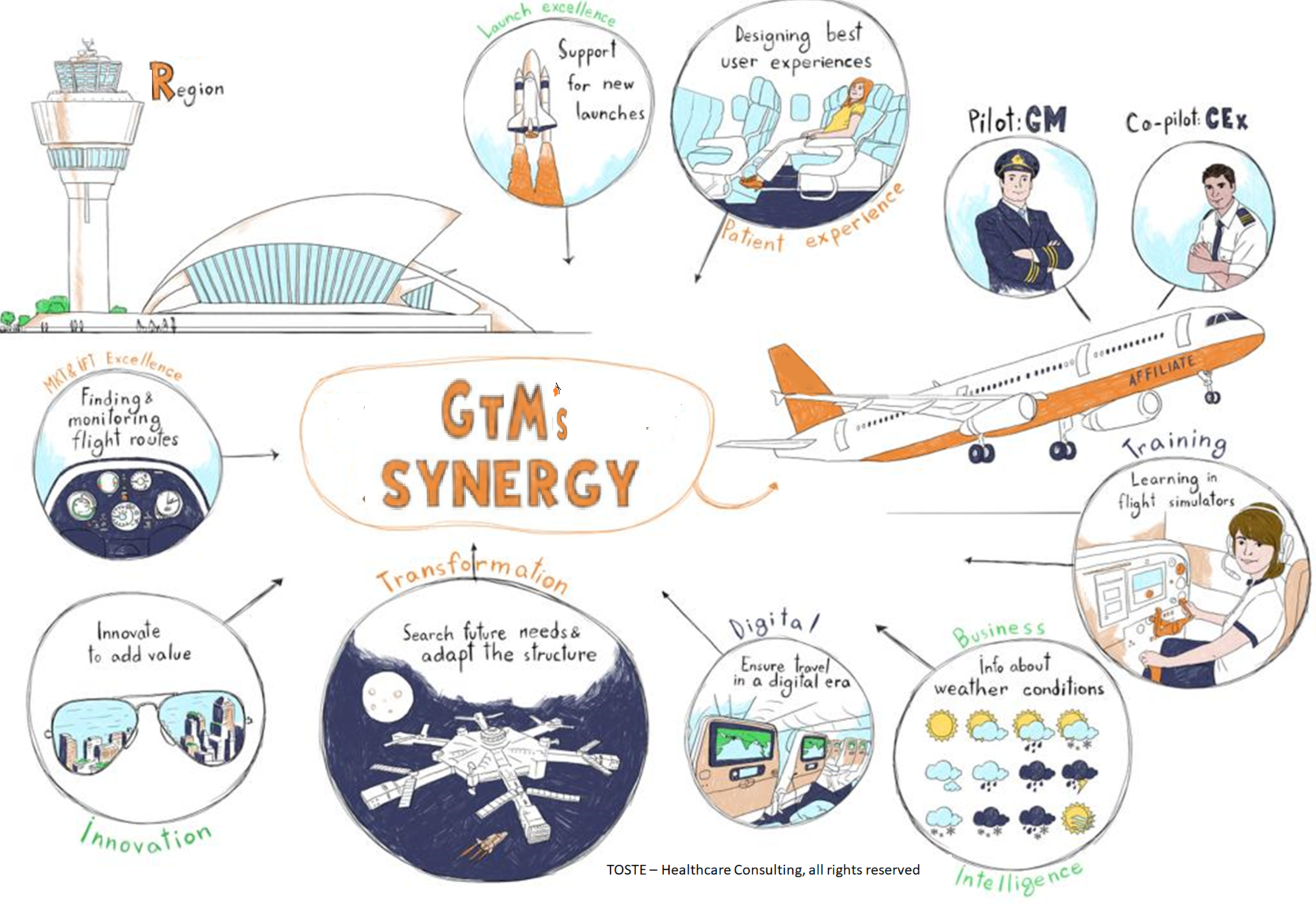

A metaphor for these synergetic capabilities:

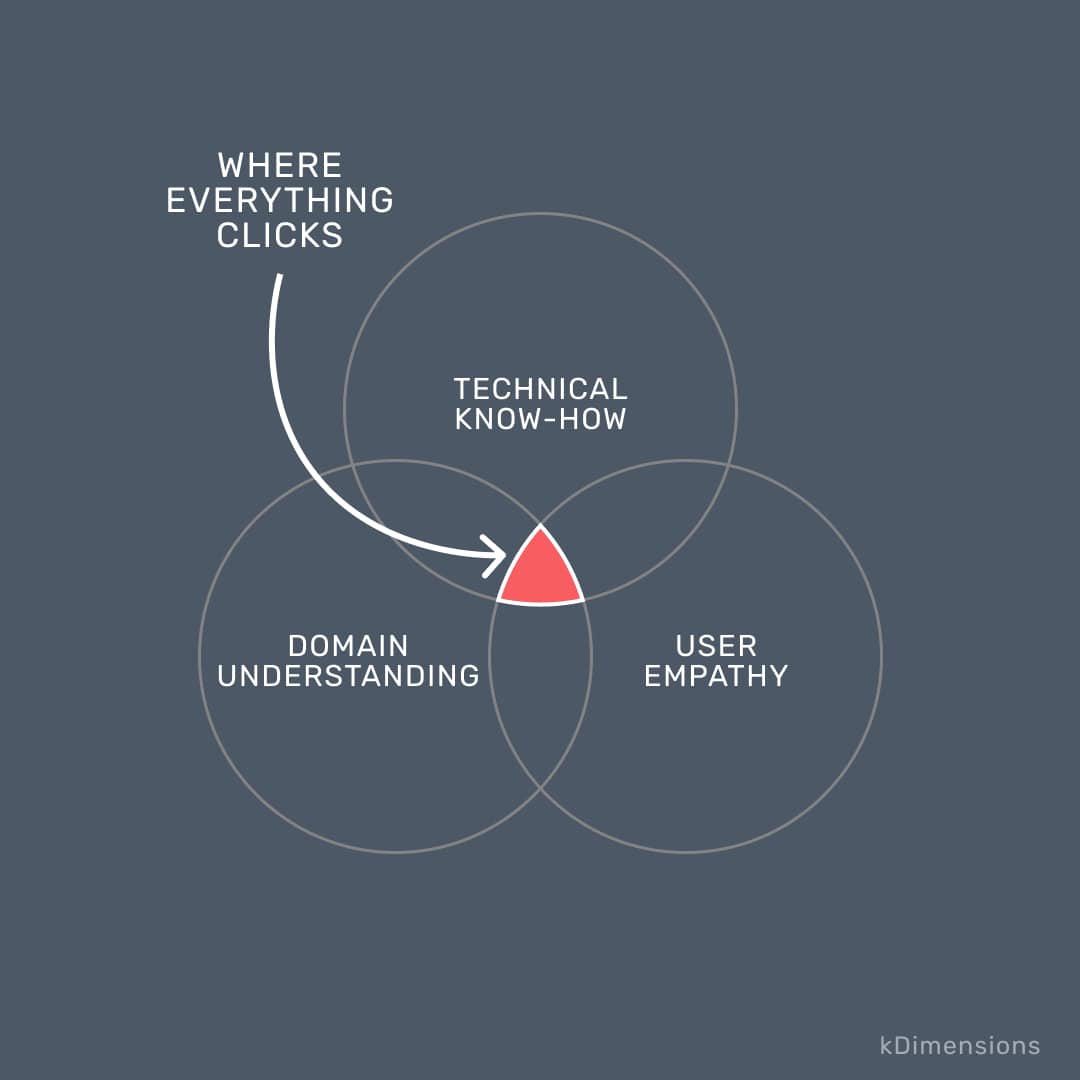

The capabilities (not necessarily functions) that contribute for it:

- Transformation / change management / project management office,

- Innovation (not product related), maybe integrated with Transformation,

- Launch excellence,

- Brand excellence,

- In-Field team excellence,

- Omnichannel engagement (including CRM management),

- Learning (management, technical, behavioral), at least till brand team level,

- Business intelligence & analytics,

- Patient experience, including patient support programs. This can be in the customer excellence department if independent from a commercial focus, or compliance kicks-in.

Keep it pragmatic

The more complex the model, the more synergies can happen by building and gathering these capabilities in one department. The complexity of it will depend on the stage of the company, portfolio, brand, services, alliances, outsourced providers, geographical activity, eg..

Keep it simple with a gradual evolution and increasing synergies - silos are to be broken. A premature or over complicated model will most probably complexify business and add costs. However, prepare for the future as to build capabilities, set multi-disciplinary teams, processing efficiency and technology embedment (plus experience, maturity and agility) do not happen overnight.

Avoid cloning the capabilities per brand, unless a new division is being incubated and requires a very different mindset.

A variable attention is to be given to some brands or therapeutic areas. Maybe the company intends to avoid

having

a brand fighting for resources face to other established revenue generators.

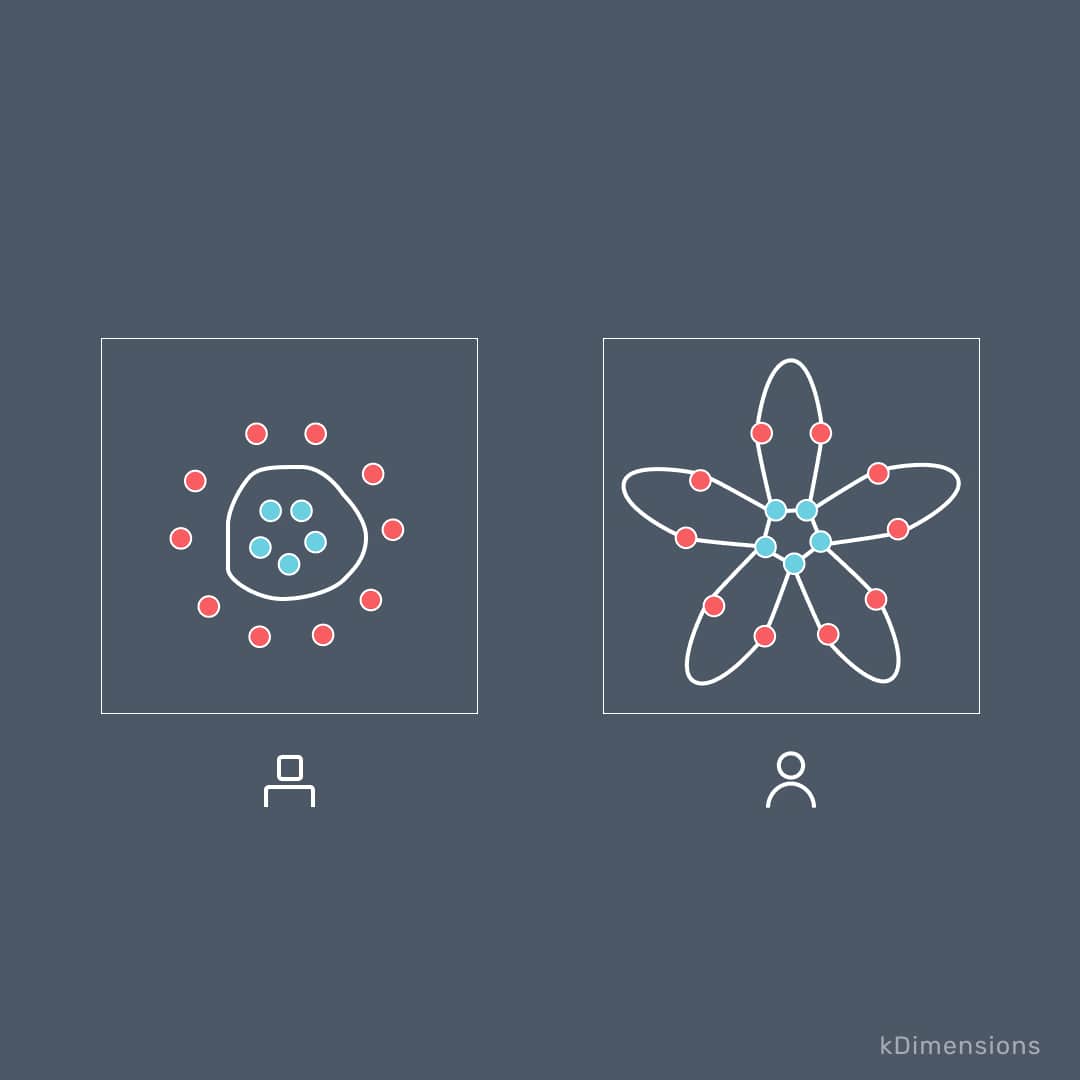

All functions involved in the GtM and commercialization phase are One Team, and similarly the capability model team supports all functions. Enabling only commercial functions is a silo perpetuation. These activities require a deep partnership between medical, market access, compliance, commercial, etc. These agile, resilient, and autonomous teams should act as brand and infield teams, developing and executing their tactical plans, infield team playbooks, account plans, and 3y/5y brand plans, eg..

The tendency for a broad medical operations department (not embarking the clinical and R&D operations) to add a customer excellence team, will be the next dogma to break, both departments should build common brand plans, with segmented tactics for each, and need to deliver the overall strategic objectives. Execution of the tactics can be segmented while coordinated and enabled in a department. As exemplified for brand plans, eg, CRM activities and databases can be shared, except the details of a medical call for an off-label discussion.

When using a GtM Capability Model to support launches, start building additional capabilities and define all needed activities at least 18 months before the launch

(according to how you define launch). As mentioned above, prepare today for tomorrow. These developments are not instantaneous.

Go-to-Market & Commercialisation Capability model trends

For the GtM, Covid highlighted some launch capabilities:

- Solid launch excellence plans to manage higher complexity,

- Focus on Omnichannel engagement, especially online content & communities, and remote engagement,

- Patient experience as a critical objective, needing:

- To revisit deeply the patient journey changes: diagnosis, treatment, e.g.,

- Reinforce patient support programs (PSPs) to alleviate professionals load supporting patients, and reinforce telehealth,

- Importance for real world evidence / data (RWE/D) to justify benefits & costs.

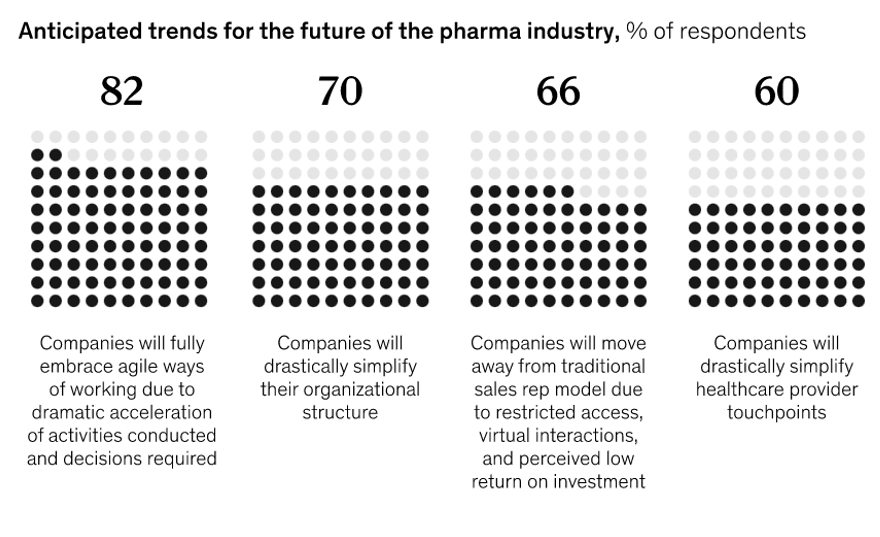

A market survey with senior healthcare managers found (Credit Mckinsey):

In this study, the higher valued responses point to agility, simplification of organizational structure, and modernization of the engagement model.

Consequently, the

most valued capabilities for the model, none yet fully embedded

(as per their feedback):

- Transformation, launch excellence, and brand excellence for:

- Agile ways of working in [clin. trials], launches and content development,

- Build new BD capabilities & practices,

- Omnichannel & business intelligence to cross-functionally elevate digital & analytics,

- Brand excellence, moving from a push to a pull marketing,

- Transformation, to ease stakeholders access to subject matter experts (SME),

- In-field team excellence to:

- Connect field roles across functions,

- Foster inside/remote sales.

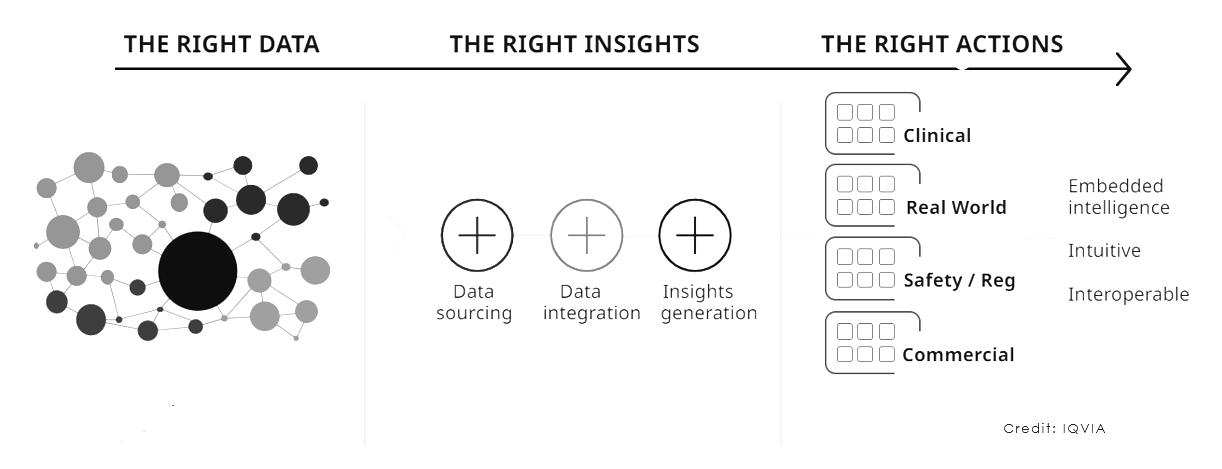

Data has also been in acceleration for some time (credit IQVIA):

The

capabilities required for the needed data focus, are:

- Omnichannel engagement that needs higher data volume management,

- Better business intelligence and artificial intelligence (AI) analytics for decision making,

- Need to ensure that (patient experience) patient support programs also gather real word evidence / data for market access and clinical.

To note that a report (credit Indegene, by DT Consulting), confirms that 'if pharma firms want to maintain this upward trajectory, they need to further strengthen their capabilities, starting with more effectively communicating their vision of what digital can do for customers.

Pharma companies failure to make significant progress on highly relevant but complex behind-the-scenes digital capabilities like analytics and CRM remains the biggest missed opportunity.'

¤

Toste - Healthcare Consulting, experts in Healthcare GtM & Commercialization Capability, executes on the strategies. with experience in affiliate, area and global scopes. Several healthcare companies - including Wyeth / Pfizer, Abbott and Abbvie - permitted exposure to 20 brands & 26 indications (including 8 biologics), during different lifecycles. Of these, 10 brands & 16 indications were launched, and 8 brands were impacted by generics.

¤

EXPERIENCE PROVEN GtM & COMMERCIALISATION CAPABILITY SOLUTIONS

We act as

- Consultants,

- Interim Management (for 'business as Unusual'):

- Lead intensive and complex change management, pe for turnarounds

- Consultancy with full hands-on implementation

- Expert additional resource, pe for explosive growth

- Qualified executive gap filler, pe sudden exit, death, sickness.

What we do

We transform Healthcare GtM & Commercialisation Capability models to adapt to strategy changes, balancing short-term performance with long-term sustainability. The model gives the structure and standards to prepare and act on the commercialization, transversal to all the company, with flexibility for the brands.

Working a mix of

- Team agile mentality,

- Capability build-up,

- Processes efficiency, and

- Technology embedment.

The scope (examples):

- Transform GtM & Commercialization capability models

- In diverse geographies, pe Middle East or France

- For different decision levels, pe global / area / affiliate or hybrid structures.

- Set-up specific operational GtMs & Comm for brands, pe, for a rare disease: market analysis, define org chart, define launch sequence, hire & train in-field and brand teams, orient brand planning

- Define or improve transversal company capabilities

- Transformation & Innovation

- Launch Excellence & Brand Excellence

- In-Field Team Excellence

- Omnichannel Engagement

- Business Intelligence & Analytics

- Learning

- Patient Experience.

- Drive transversal projects, pe, create a dashboard, set-up a new KAM model

- Define and deliver on existing or new functions, pe, create a job spec and fill it until roll-out is secured

As capabilities & processes

Click on the rows for examples of projects developed.

Most were sustained over time, and several became use cases, were awarded, or turned into embryos for global projects.

Learnings for building one

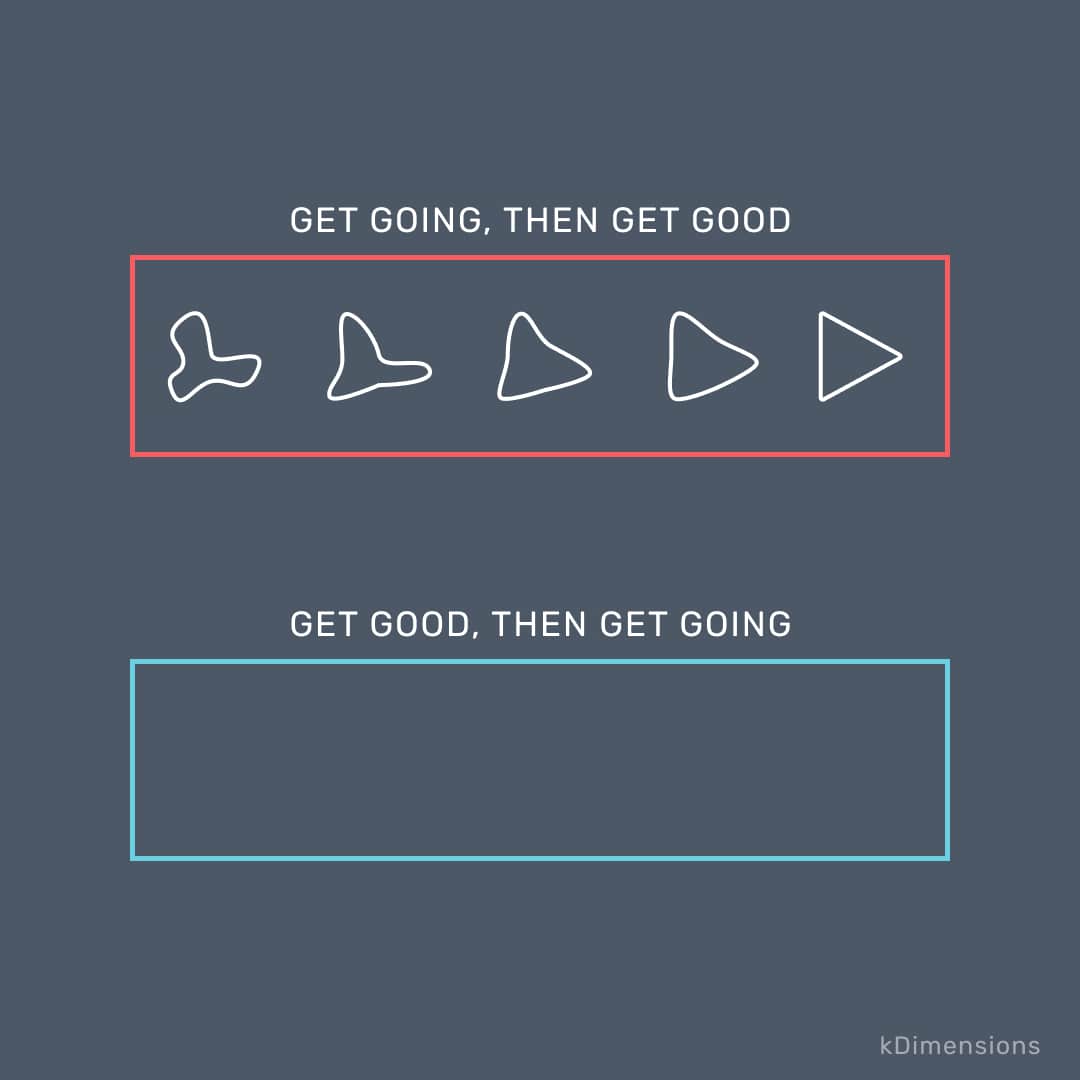

Realistically, you will be building the plane while flying. Many times the build-up of capabilities, the development of people, the increase of processes efficiency, and the technology embedment, do not grant the luxury to structure and only then operate.

With a plan, 'get going, then get good'.

To pursue excellent solutions, sometimes it's just need to start.

A vision and a plan to achieve a significant objective is needed, though sometimes factors are not in favor with, eg, resources available, workload balance, short-term goals vs long-term investment, or the learning curve.

Teamwork and synergies, when a group of people subordinate their individual objectives to a common goal, are mandatory. These activities require a full partner of global / area VPs / GMs and are Enablers, proactively finding the best solutions while co-creating and implementing with their peers.

It's important that

management endorsement be balanced with internal stakeholders buy-in, or:

- High endorsement & Low buy-in => policing burden,

- Low endorsement & High buy-in => ad-hoc actions.

Lastly, the importance of affiliates is not to be neglected. The business impact and the accountability is there. This means more autonomy in decision making as their agility generally leads to innovation and use cases for area or global.

Our efforts are to find efficient & distinctive solutions.

¤

Toste - Healthcare Consulting, experts in Healthcare GtM & Commercialisation Capability, executes on the strategies. with experience in affiliate, area and global scopes. Several healthcare companies - including Wyeth / Pfizer, Abbott and Abbvie - permitted exposure to 20 brands & 26 indications (including 8 biologics), during different lifecycles. Of these, 10 brands & 16 indications were launched, and 8 brands were impacted by generics.

¤

TESTIMONIALS

When we clicked

Some of the comments that incentivize us to run the extra mile. Access their LinkedIn clicking on the photos / text.

List of services

-

M. SwindellList Item 1

Francisco is highly driven with an entrepreneurial style that is refreshing in challenging the "norms" that can slow large organizations and he thrives in leading changing initiatives.

Ex President Asia, Pfizer;

CCO, Avillion

-

S. CurranList Item 3

Significant contributions to driving excellence in global and regional operations and customer engagement strategies with a keen eye and attention to in-market implementation.

Board Advisor & Non Exec. Dir, Morphosys, Clinigen, Noden, Circassia.

-

Z. Jakab

A broad and deep understanding of the innovative pharma business: what drives success, what are each functions' contributions and the value of cross functional operation. Affiliate and global perspective. Has worked with advanced and developing markets as well. He has a strong inner drive to contribute in a meaningful way and can manage multiple complex projects. We have grown together.

Regional VP Central Eastern Europe, Abbvie

-

R. Tannenbaum

An outstanding customer excellence professional supporting both internal customers facing teams and external customers. His strong analytical skills help him focus on the right strategies to grow the business. His patient focus supports efforts to improve the patient journey. His global experience enables him to support complex developed and developing markets.

Board Dir., Zogenix Inc, Cardiff Oncology

-

J. Oleszczuk

A true leader. We worked hand in hand creating and driving the explosive growth of the CEE and then EEMEA regions at AbbVie. Always on the lookout for opportunities and always asking "how can I help". Beyond the question, he always had several ready answers which really nailed the issue. He has also always been an authentic friend, no corpo BS type of guy - just straight to the point. His focus on results is unparalleled, while always being full of empathy, emotion and understanding. His deep level of expertise in pharma commercial operations is a true asset. I recommend Francisco without hesitation and truly hope we work together again!

Founding Partner, Epixpert, Axcend Health.

Board Member, Genomtec.

Advisor, Polish Development Fund, Rita Health

-

P. Pepe

An outstanding customer excellence professional and a true business leader. He fully understands the business value of compliance and has been a great ally and partner in many projects aimed at raising the compliance and business profile. I wholeheartedly recommend Francisco.

President, Quantum Ethics.

Lecturer Compliance & Ethics at Sciences Po.

Board Member at ETHICS Assoc.

-

F. Dupre

A solid professional very well experienced in all capability development skills (Brand excellence, In field team excellence, digital transformation, wining with data and patient experience). He has personally implemented different projects in multiple countries to ensure the affiliates were able to progress in their transformation journey on those key topics. On top of those business skills, Francisco has strong interpersonal and multicultural skills and is eager to contribute to people development and flourishing.

VP & Country Commercial Overlay for France, Medtronic.

-

G. SarvariList Item 2

An outstanding and committed leader who puts the interest of the group above the individual interest, unbrokenly represents truth versus falsehood and egoism, and the community and organizational goals above the personal goals.

PhD. GM, Coach & Org. Development, Bardo Consulting

-

H. ArnotList Item 4

Simply the consummate all-rounder. A leader that makes change happen given his commitment, deep understanding of what it will take and strong relationships. Maintains a strategic perspective while driving operational excellence. A great person to work with who always makes a difference.

GM, ArnotConsult, Strategy advise.

Ex Mckinsey Strategy Consultant.

-

A. Dasgupta

He brings extreme passion yet realism to his role and the organization. Focus was entirely on how to bring value to the affiliates and how to improve their ability to execute. He has been a true partner in the journey with technology organization looking beyond functional boundaries and "territories" and always willing to collaborate.

VP & Head Of Business Technology Solutions, Strategy & Continuous Improvement, AbbVie

-

R. Mascarenhas

Francisco represents the essence of team spirit and innovation that coupled together make him one of the most inspirational leaders that I have ever worked with. One strength in particular is the ability to pinpoint the right corrective action but still keeping it real and motivating for his peers / team. It was a pleasure to learn from him and sure hope our paths cross again.

Senior Director US BU Strategy and Launch Readiness EoE, Takeda

-

P. Detours

I know few people only working with the dedication of Francisco for its missions. He is somebody you can count on to get things done, no matter how much work this may require. I also very much appreciated his solidity as a person. He has got ideas of his own, presents and defends them honestly. He is a willing and active contributor.

Head of Dental Distribution, EMEA ex. Dach&Bx

-

M. Assem

Francisco is the very definition of an entrepreneur. He has a strong drive, zest for success and comprehensive knowledge of all aspects of the business and people management. He brings a rare set of skills and experience in strategic management and problem solving. He is a thoughtful human on the personal side, that I am proud to have called “Boss” for almost 4 years. He has helped me grow.

Global Brand Excellence Dir., Abbvie

-

N. Leach

With great insight and understanding of the markets, Francisco excelled at adapting global programs to ensure success in a very diverse region. Also developed regional programs which were then adopted globally. I would recommend to anyone wanting to grow their business and improve execution. With strong business acumen and market knowledge, future success is assured.

CEO on Purpose Solutions.

Author, Leading On Purpose.

-

R. Pascoa

When I first started to work with Francisco Toste, I soon realized that he has a unique set of key competencies that are, from my perspective, very difficult to be balanced – a global view from the business both commercial and financial, a deep interest in all products and key market characteristics, a good sense to take decisions, results oriented, a solid professional experience, a team player attitude, and an infinite stamina. “Impossible” is a word that Francisco does not know. I strongly believe that he's a key asset. I would work with him anytime and at any project.

Global HR Director, Mergers & Acquisitions & Alliances, Pfizer

¤

Toste - Healthcare Consulting, experts in Healthcare GtM & Commercialisation Capability, executes on the strategies. with experience in affiliate, area and global scopes. Several healthcare companies - including Wyeth / Pfizer, Abbott and Abbvie - permitted exposure to 20 brands & 26 indications (including 8 biologics), during different lifecycles. Of these, 10 brands & 16 indications were launched, and 8 brands were impacted by generics.

¤

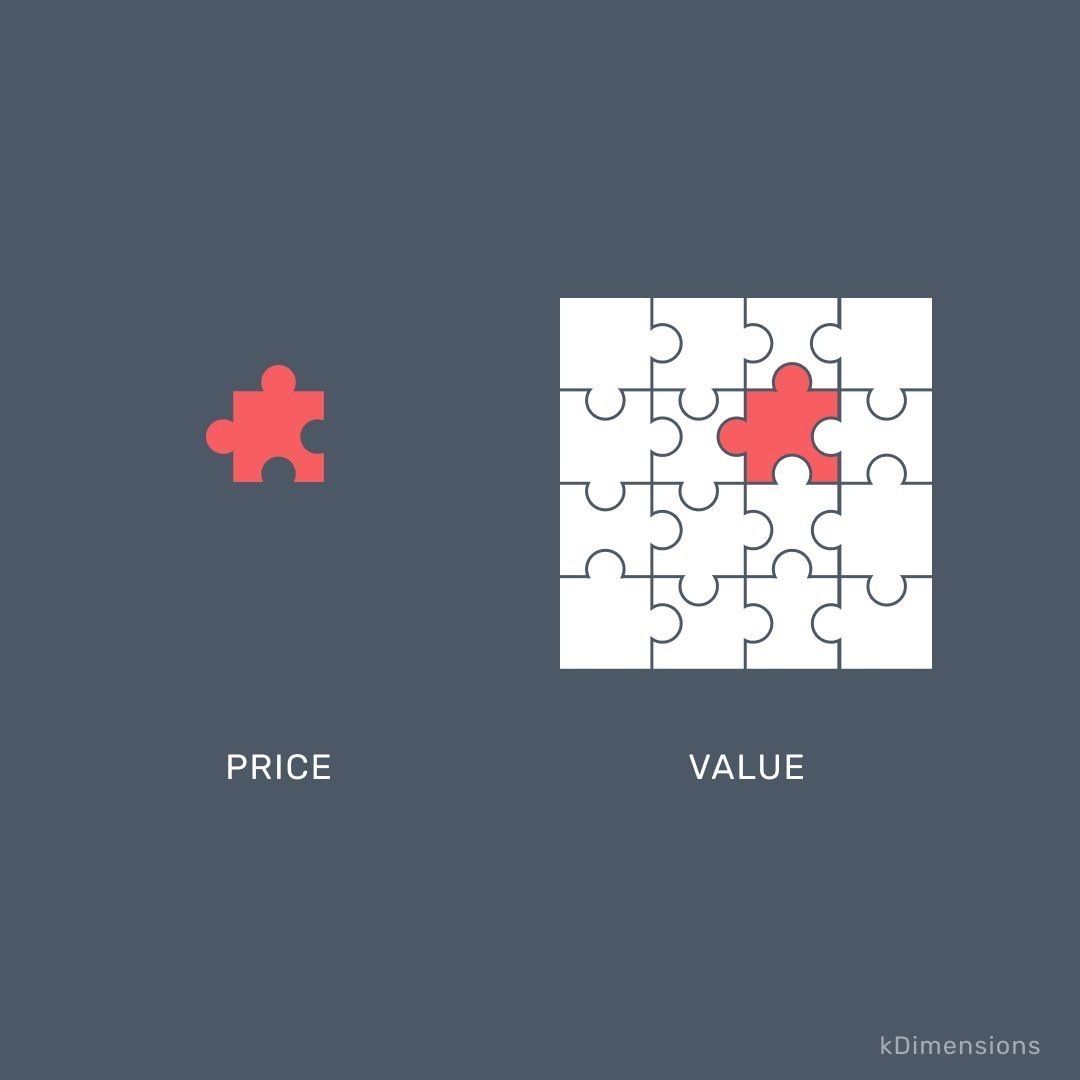

YOUR NEEDS ARE OUR MANDATE

We transform Healthcare Go-to-Market (GtM) & Capability models to adapt to strategy changes, balancing short-term performance with long-term sustainability. The model gives the structure and standards to prepare and act for the commercialization, transversal to all the company and flexibility on the brands.

We do not channel for 'favorite' solutions. We want to freely discuss your needs, share ideas, define potential solutions, show value, and then have the possibility to pitch for a project.

We do not shy away from any structural project in the commercialization arena, big or small, to build or reinforce, in turnarounds or growth, along the brand lifecycle, from global to affiliate. Passion, pragmatism.

Sometimes a smaller consulting company faces a judgement versus bigger ones but (credit Gallagher & Associates):

"The four pillars of traditional consulting:

- Information,

- Insight,

- Expertise,

- Execution ...

... are no longer the sole domain of big consulting. The key is to close the gap between the idea and the execution."

Twenty years of immersion in ideation, delivering, and living with the results prove our superior execution.

Our Value Proposition

Click on the rows

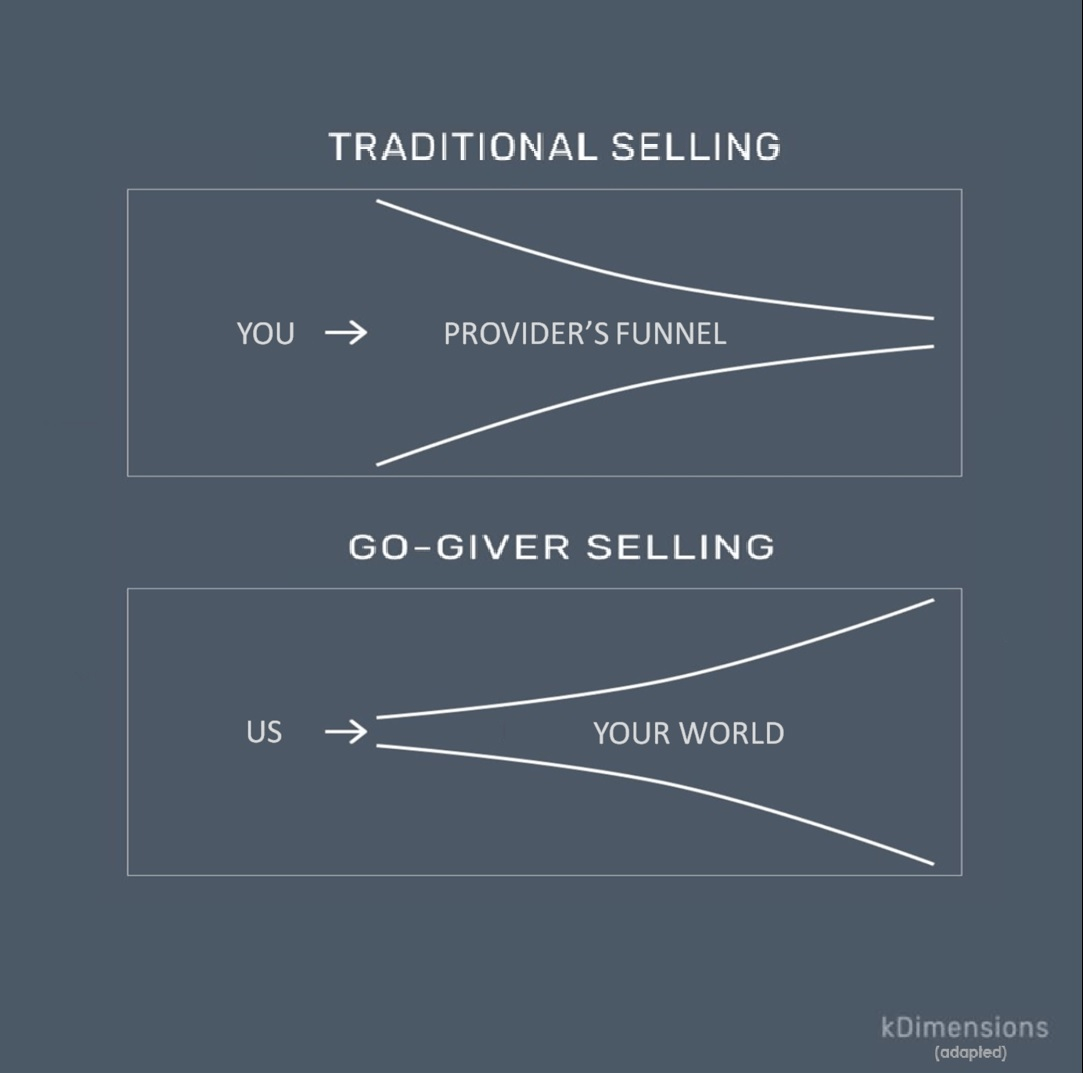

Our Engagement Methodology

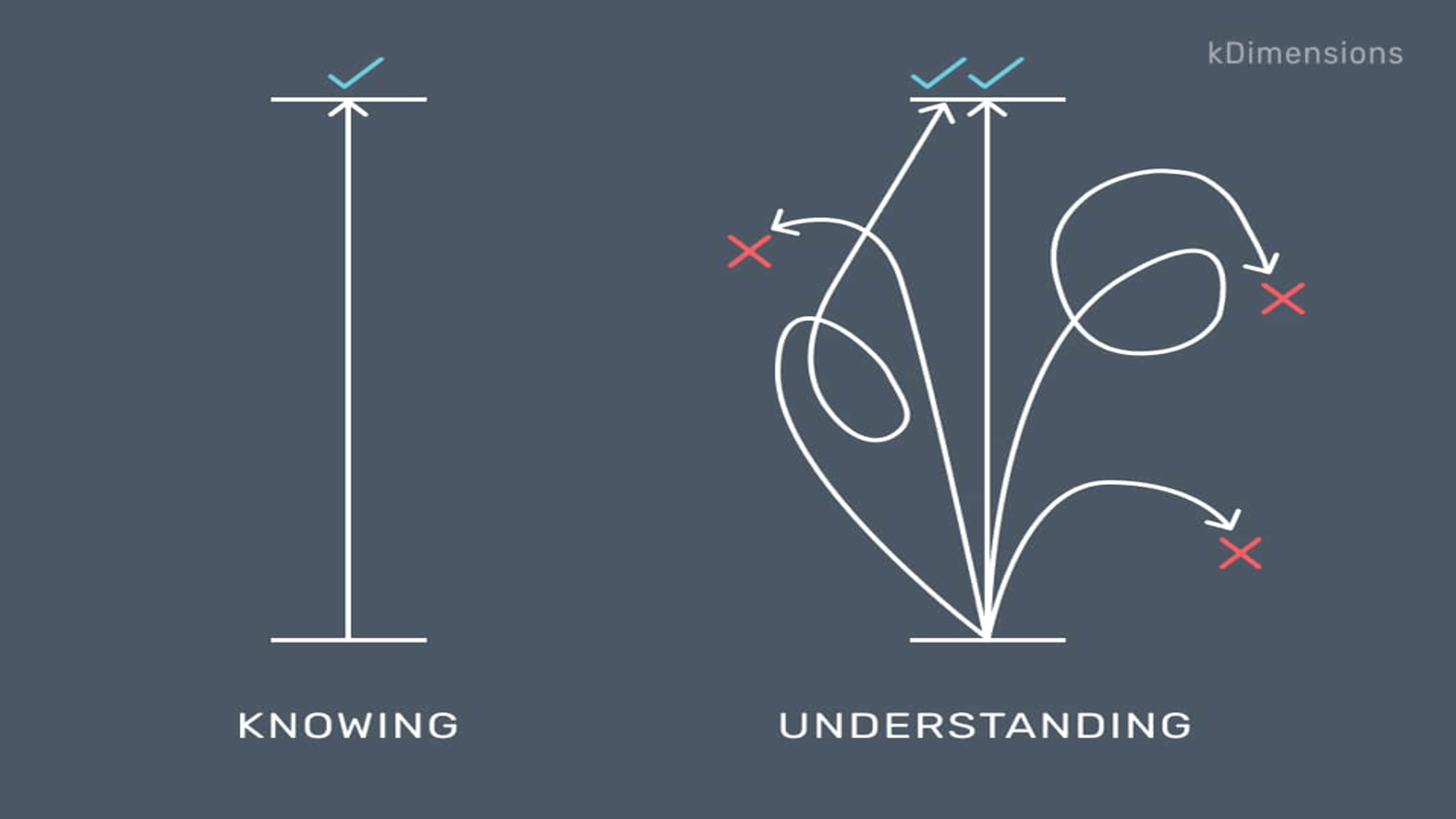

Our business approach is to Understand YOU

To start a direct communication

Our objective is to know you and then to Understand You. To have interactions where we learn and address problems together, starting now or later, and to become an extended resource for your team.

Now its time to Turn-It ON and engage with us:

- Contact us functionality

- francisco.toste@toste.eu

- +351.913.235.570 (also WhatsApp)

Speak soon.

Francisco

¤

Toste - Healthcare Consulting, experts in Healthcare GtM & Commercialisation Capability, executes on the strategies. with experience in affiliate, area and global scopes. Several healthcare companies - including Wyeth / Pfizer, Abbott and Abbvie - permitted exposure to 20 brands & 26 indications (including 8 biologics), during different lifecycles. Of these, 10 brands & 16 indications were launched, and 8 brands were impacted by generics.

¤

Healthcare Go-to-Market & Commercialisation Capability